Tax Return Correction Notice – Illinois Department of Revenue

Are you checking the status of your Illinois Tax Refund at Illinois Tax - Where's My Refund? only to find the status the same for several weeks or even months? You may see the following status update that does not change:

We have received your tax return. Please allow time for it to fully process. This message will be updated once your return has been processed.

In some cases, if you’ve waited long enough, you will see the status of your return finally change with the following message(s):

We have completed processing your return. In processing your return, we have made a change to your return or refund. We have issued you a notice regarding your return. If you have not received this notice, please allow ten business days for delivery.

And / Or..

We have completed processing your return and have released your refund to the Illinois Comptroller. Typically refunds are issued within 10 business days after we release them to the Comptroller’s office.

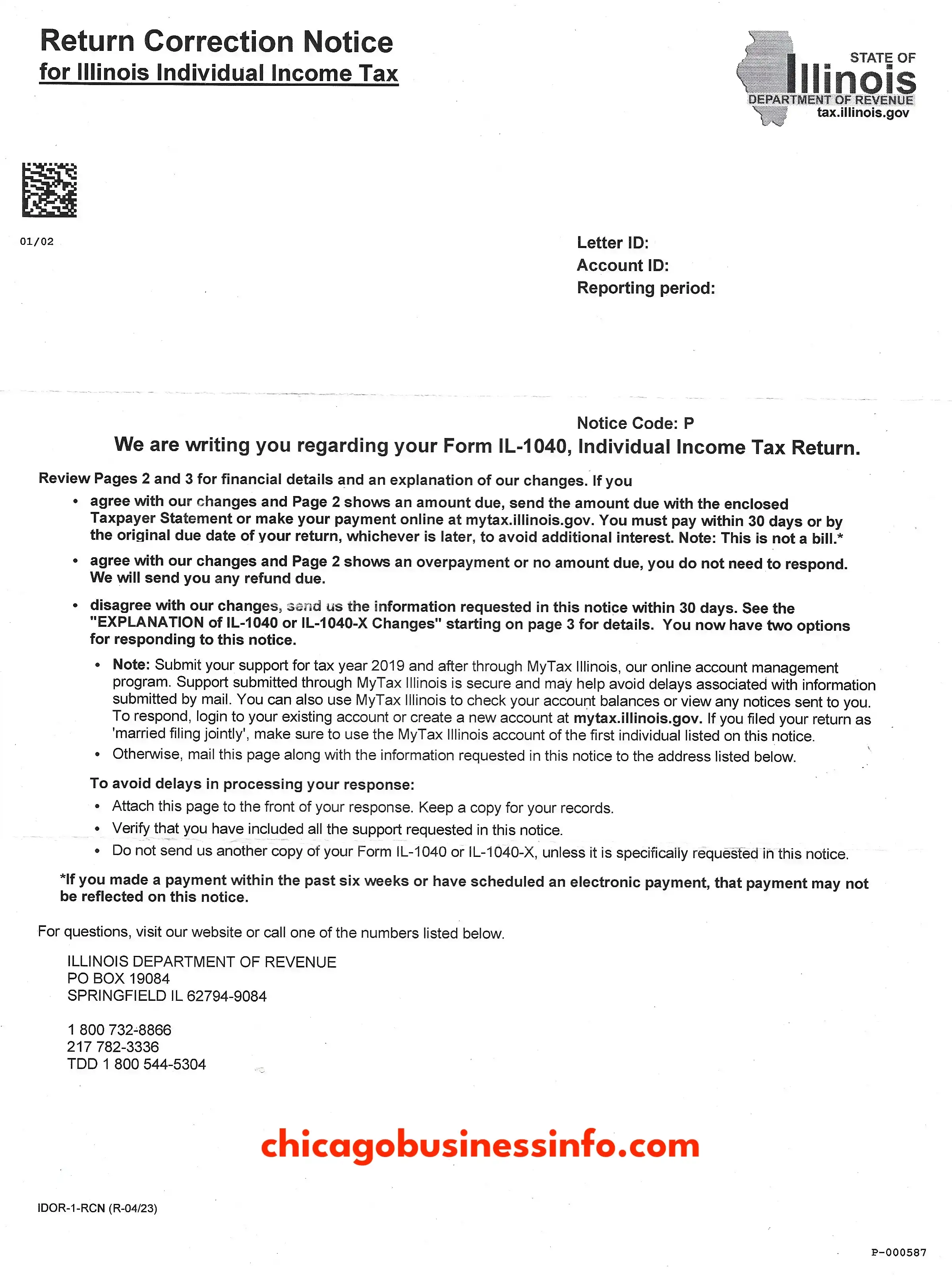

After the status change, you will receive a Return Correction Notice letter mailed from the State Of Illinois Department Of Revenue 3 – 10 days later to the address you filed your Tax Return. You will need to wait to receive your letter in the mail before you can take any action.

It is important to understand that this letter is not part of or initiating an audit. This letter provides the change(s) the Illinois Department of Revenue made to your IL-1040 individual tax return based on their record keeping. In most cases, there is no action required from you.

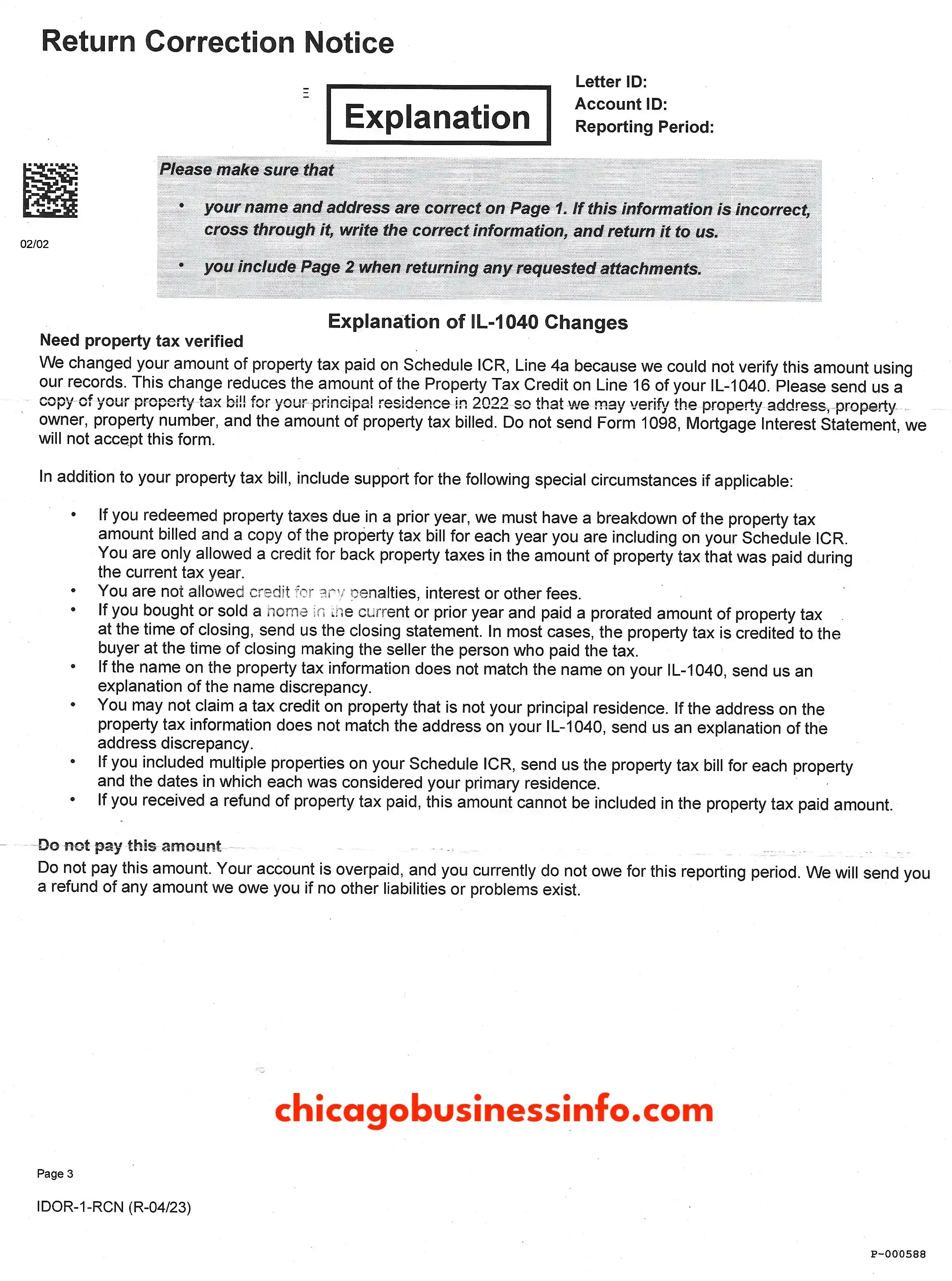

In the example below, it was found the property tax paid the prior year did not match what the state had on file and needed verification. This was the taxpayer/preparer’s fault. Thus, the letter notified the taxpayer only a partial Illinois state refunded and no further action was needed.

For more information on Illinois Tax Return Correction Notices (RCN), visit I received a Return Correction Notice (RCN). What should I do?

Use the comment form below to share if you received a similar letter and how you responded.

Example of Return Correction Notice Illinois Individual Income Tax – Illinois Department Of Revenue

Want to Submit a listing, deal, or something else? Learn more here.

*Comment below let us know outdated info, closings, feedback, reviews, or anything else related.*

Comments